Cybersecurity in FinTech: A Machine Learning-Based Framework for Threat Detection in Mobile Payments

DOI:

https://doi.org/10.58190/imiens.2025.151Keywords:

Anomaly Detection, Cybersecurity, Fintech, Machine Learning, Mobile PaymentsAbstract

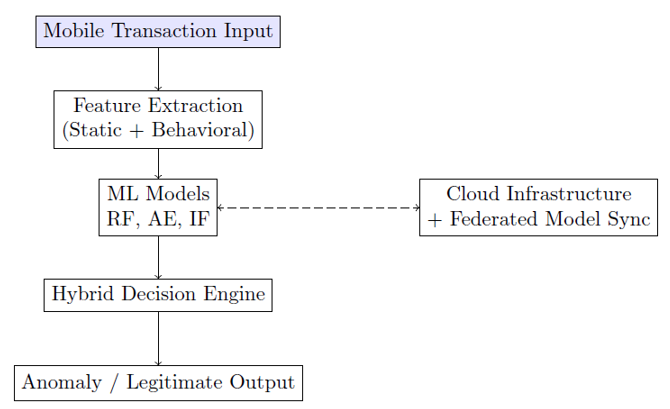

The rapid evolution of Financial Technology (FinTech) has revolutionized mobile payment systems, offering seamless, efficient, and real-time financial services. However, this digital transformation has simultaneously introduced complex cybersecurity challenges, particularly as cybercriminals increasingly exploit mobile platforms. This study proposes a novel machine learning-based framework for proactive threat detection in mobile payment environments, integrating behavioral analytics, device fingerprinting, and network anomaly detection. The framework leverages supervised and unsupervised learning models—such as Random Forest, Isolation Forest, and Autoencoders—to identify both known and zero-day threats with high precision. A hybrid feature engineering pipeline is also introduced, combining static application metadata with dynamic transaction behavior to enhance detection accuracy. Experimental results on real-world mobile payment datasets demonstrate that the proposed framework achieves superior performance in terms of precision, recall, and F1-score compared to traditional signature-based and rule-based detection systems. This research contributes to the advancement of secure FinTech ecosystems by offering a scalable and adaptive solution for real-time cyber threat mitigation in mobile payments.

Downloads

References

[1] M. Asmar and A. Tuqan, “Integrating machine learning for sustaining cybersecurity in digital banks,” Heliyon, vol. 10, no. 17, 2024.

[2] M. S. K. Munira, “Assessing the influence of cybersecurity threats and risks on the adoption and growth of digital banking: A systematic literature review,” Available at SSRN: 5229868, 2025.

[3] K. K. Boorugupalli, A. K. Kulkarni, A. Suzana, and S. Ponnusamy, “Cybersecurity Measures in Financial Institutions Protecting Sensitive Data from Emerging Threats and Vulnerabilities,” in ITM Web of Conferences, EDP Sciences, 2025, p. 02002.

[4] S. Dhaiya, B. K. Pandey, S. B. K. Adusumilli, and R. Avacharmal, “Optimizing API Security in FinTech Through Genetic Algorithm based Machine Learning Model,” International Journal of Computer Network and Information Security, vol. 13, p. 24, 2021.

[5] W. C. Aaron, O. Irekponor, N. T. Aleke, L. Yeboah, and J. E. Joseph, “Ma-chine learning techniques for enhancing security in financial technology systems,” 2024.

[6] O. E. Ejiofor, “A comprehensive framework for strengthening USA financial cybersecurity: integrating machine learning and AI in fraud detection systems,” European Journal of Computer Science and Information Technology, vol. 11, no. 6, pp. 62–83, 2023.

[7] A. T. Olutimehin, “The Synergistic Role of Machine Learning, Deep Learning, and Reinforcement Learning in Strengthening Cyber Security Measures for Crypto Currency Platforms,” Deep Learning, and Reinforcement Learning in Strengthening Cyber Security Measures for Crypto Currency Platforms (February 11, 2025), 2025.

[8] M. Ononiwu, T. I. Azonuche, O. F. Okoh, and J. O. Enyejo, “Machine Learning Approaches for Fraud Detection and Risk Assessment in Mobile Banking Applications and Fintech Solutions,” 2023.

[9] N. Mirza, M. Elhoseny, M. Umar, and N. Metawa, “Safeguarding FinTech innovations with machine learning: Comparative assessment of various approaches,” Res Int Bus Finance, vol. 66, p. 102009, 2023.

[10] U. Noor, Z. Anwar, T. Amjad, and K.-K. R. Choo, “A machine learning-based FinTech cyber threat attribution framework using high-level indicators of compromise,” Future Generation Computer Systems, vol. 96, pp. 227–242, 2019.

[11] R. Karangara, “Adaptive Machine Learning Models for Securing Payment Gateways: A Resilient Approach to Mitigating Evolving Cyber Threats in Digital Transactions,” Artificial Intelligence Evolution, pp. 44–64, 2025.

[12] A. Faccia, “National payment switches and the power of cognitive computing against fintech fraud,” Big Data and Cognitive Computing, vol. 7, no. 2, p. 76, 2023.

[13] A. Adejumo and C. Ogburie, “Strengthening finance with cybersecurity: Ensuring safer digital transactions,” World Journal of Advanced Research and Reviews, vol. 25, no. 3, pp. 1527–1541, 2025.

[14] S.-Y. Hwang, D.-J. Shin, and J.-J. Kim, “Systematic review on identification and prediction of deep learning-based cyber security technology and convergence fields,” Symmetry (Basel), vol. 14, no. 4, p. 683, 2022.

[15] S. Paleti, V. Pamisetty, K. Challa, J. K. R. Burugulla, and A. Dodda, “Innovative Intelligence Solutions for Secure Financial Management: Optimizing Regulatory Compliance, Transaction Security, and Digital Payment Frameworks Through Advanced Computational Models,” Transaction Security, and Digital Payment Frameworks Through Advanced Computational Models (December 10, 2024), 2024.

[16] H. Rabbani et al., “Enhancing security in financial transactions: a novel blockchain-based federated learning framework for detecting counterfeit data in fintech,” PeerJ Comput Sci, vol. 10, p. e2280, 2024.

[17] V. N. Kollu, V. Janarthanan, M. Karupusamy, and M. Ramachandran, “Cloud-based smart contract analysis in fintech using IoT-integrated federated learning in intrusion detection,” Data (Basel), vol. 8, no. 5, p. 83, 2023.

[18] H. R. B. Seshakagari and D. HariramNathan, “AI-Augmented Fraud Detection and Cybersecurity Framework for Digital Payments and E-Commerce Platforms,” International Journal of Computational Learning & Intelligence, vol. 4, no. 4, pp. 832–846, 2025.

[19] H. Xia, Y. Wang, J. Gauthier, and J. Z. Zhang, “Knowledge graph of mobile payment platforms based on deep learning: Risk analysis and policy implications,” Expert Syst Appl, vol. 208, p. 118143, 2022.

[20] B. Stojanović et al., “Follow the trail: Machine learning for fraud detection in Fintech applications,” Sensors, vol. 21, no. 5, p. 1594, 2021.

[21] K. Upreti, M. H. Syed, M. A. Khan, H. Fatima, M. S. Alam, and A. K. Sharma, “Enhanced algorithmic modelling and architecture in deep reinforcement learning based on wireless communication Fintech technology,” Optik (Stuttg), vol. 272, p. 170309, 2023.

[22] I. O. Owolabi, C. K. Mbabie, and J. C. Obiri, “AI-Driven Cybersecurity in FinTech & Cloud: Combating Evolving Threats with Intelligent Defense Mechanisms,” International Journal of Multidisciplinary Research in Science, Engineering and Technology, vol. 7, p. 12, 2024.

[23] R. Ramadugu, “Effectiveness Of Natural Language Processing Based Security Tools In Strengthening The Security Over Fin-Tech Platforms,” International Journal of Creative Research Thoughts, vol. 11, no. 8, pp. 199–219, 2023.

[24] M. Williams, M. F. Yussuf, and A. O. Olukoya, “Machine learning for proactive cybersecurity risk analysis and fraud prevention in digital finance ecosystems,” ecosystems, vol. 20, p. 21, 2021.

[25] S. Ryu, J. Kim, and N. Park, “Study on Trends and predictions of convergence in Cybersecurity Technology using machine learning,” Journal of Internet Technology, vol. 24, no. 3, pp. 709–725, 2023.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Intelligent Methods In Engineering Sciences

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.